Discover Your Options: Medicare Advantage Plans Near Me

Discover Your Options: Medicare Advantage Plans Near Me

Blog Article

Browsing the Registration Refine for Medicare Advantage Insurance

As people come close to the phase of taking into consideration Medicare Benefit insurance policy, they are consulted with a maze of selections and guidelines that can occasionally feel frustrating. Recognizing the qualification needs, numerous coverage choices, registration periods, and the required steps for enrollment can be a formidable job. Having a clear roadmap can make this navigation smoother and a lot more manageable. Let's discover how to successfully browse the enrollment process for Medicare Benefit insurance policy.

Qualification Requirements

To get approved for Medicare Benefit insurance coverage, individuals need to fulfill specific eligibility requirements described by the Centers for Medicare & Medicaid Provider (CMS) Eligibility is largely based upon variables such as age, residency status, and registration in Medicare Part A and Part B. Most people aged 65 and older get Medicare Benefit, although particular individuals under 65 with certifying handicaps might also be qualified. Additionally, people need to stay within the service location of the Medicare Advantage strategy they wish to sign up in.

In addition, people need to be signed up in both Medicare Component A and Component B to be qualified for Medicare Advantage. Medicare advantage plans near me. Medicare Advantage strategies are called for to cover all solutions provided by Original Medicare (Part A and Part B), so registration in both components is required for people seeking protection through a Medicare Benefit strategy

Coverage Options

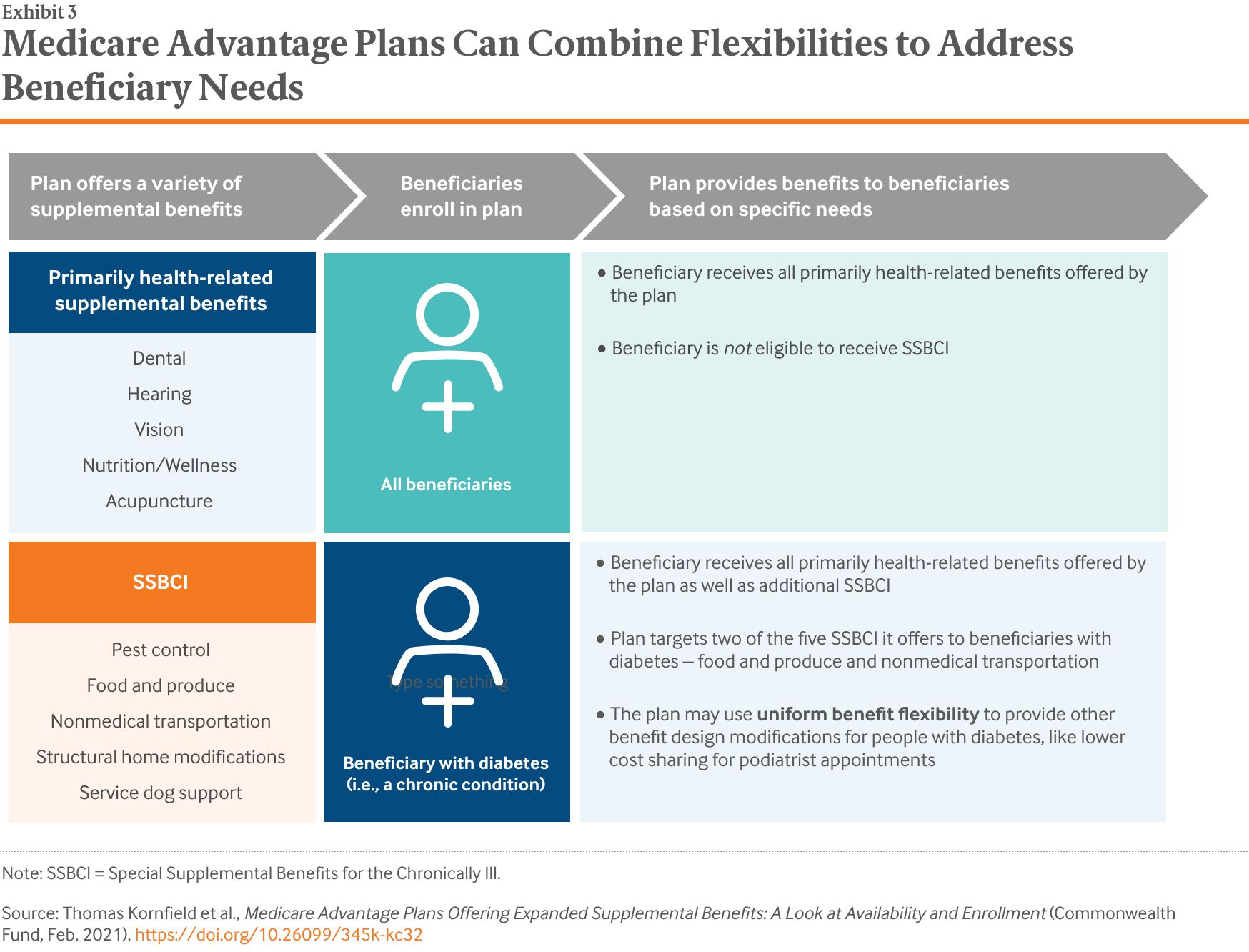

Having actually fulfilled the eligibility requirements for Medicare Benefit insurance policy, individuals can now discover the different insurance coverage options readily available to them within the plan. Medicare Advantage intends, also referred to as Medicare Component C, supply an "all-in-one" option to Original Medicare (Part A and Part B) by giving fringe benefits such as prescription medication protection (Part D), vision, oral, hearing, and health care.

One of the main protection choices to consider within Medicare Benefit plans is Health and wellness Maintenance Organization (HMO) strategies, which normally call for people to select a main treatment doctor and obtain references to see experts. Special Needs Plans (SNPs) provide to people with details health conditions or those that are dually qualified for Medicare and Medicaid.

Comprehending these protection options is important for people to make informed choices based upon their health care demands and preferences.

Enrollment Periods

Actions for Registration

Recognizing the enrollment durations for Medicare Benefit insurance coverage is crucial for beneficiaries to navigate the process successfully and effectively, which starts with taking the essential actions for enrollment. The very first step is to identify your eligibility for Medicare Advantage. You should be signed up in Medicare Part A and Component B to get a Medicare Benefit strategy. When eligibility is validated, research study and contrast available plans in your location. Take into consideration factors such as costs, deductibles, copayments, coverage choices, and supplier networks to pick a strategy that finest fits your healthcare requires.

You can enroll straight through the insurance policy company offering the plan, with Medicare's web site, or by calling Medicare straight. Be sure to have your Medicare card and individual details all set when signing up.

Tips for Decision Making

When examining Medicare Benefit intends, it is necessary to meticulously analyze your private medical care demands and economic considerations to make a notified choice. To help in this process, think about the complying with tips for decision making:

Contrast Plan Options: Research study offered Medicare Benefit prepares in your area. Compare their costs, protection benefits, company networks, and top quality ratings to determine which aligns best with your demands.

Think About Out-of-Pocket Expenses: Look beyond the regular monthly costs and think about aspects like deductibles, copayments, and coinsurance. Calculate prospective yearly costs based on your healthcare usage to find the most cost-efficient option.

Evaluation Star Scores: Medicare assigns star rankings to Advantage plans based on elements like client contentment and quality of care. Choosing a highly-rated plan may show far better total performance and service.

Final Thought

Finally, comprehending the qualification requirements, coverage options, registration durations, and actions for enlisting in Medicare Benefit insurance policy is essential for making educated choices. By browsing the enrollment process successfully and taking into consideration all offered information, individuals can guarantee they are selecting the most effective plan to satisfy their healthcare requires. Making educated choices during the enrollment procedure great site can result in better health end results and financial safety and security in the future.

Report this page